I miss my more carefree days– which didn’t seem carefree, until now, when I have several appointments after each 8-hour workday in the warehouse, health issues to sort, a job hunt and debt to pay. Life is never simple or easy for most of us, but 2023 has, for me, felt like eternal optimism and hope while being bludgeoned. I get my proverbial sh*t together, and something outside of my control decides to parachute into my life.

When Stitch Fix announced closing the Bizzy Hizzy, they scheduled all sorts of guests and workshops for us as displaced employees. My separation date is September 15, so I have four more weeks, or two more paychecks, depending how you look at it. One of the workshops Stitch Fix hosted, and paid us to attend, was a visit from the state “Rapid Response” team to explain how unemployment and career services from the state work. They handed us a booklet that told us how to survive our layoff. (Surviving a Layoff: Your Guide to a Soft Landing and a Smooth Re-entry by Harry Dahlstrom. Mr. Dahlstrom, I’m sure you’re a very intelligent and likable person, but your advice is written for middle class Americans with two cars and their own house.)

“Remember that emergency fund with three-months pay stashed away…” Oh, Mr. Dahlstrom. Do you not have a child going to college this fall? Or medical debt? Or a used car that needs constant repairs? Or a teenager whose car insurance costs $500/month because of an accident? That’s just me. Others might have a disabled or unemployed spouse, student loans, bad credit that led to predatory loans for everyday items… or maybe they just recently got this job and had been using their credit cards to survive.

“Reduce your thermostat to 68 degrees.” Oh, Mr. Dahlstrom, mine has been at 64 for two decades.

“Trim your entertainment.” I don’t have cable. I don’t have any streaming services (though the Teenager has Spotify, which she pays for, and she also bought HBO Max and made for the year upfront.) I don’t even have home internet, relying on my phone’s hotspot and public connections. I think the last time I went to a movie was two years ago.

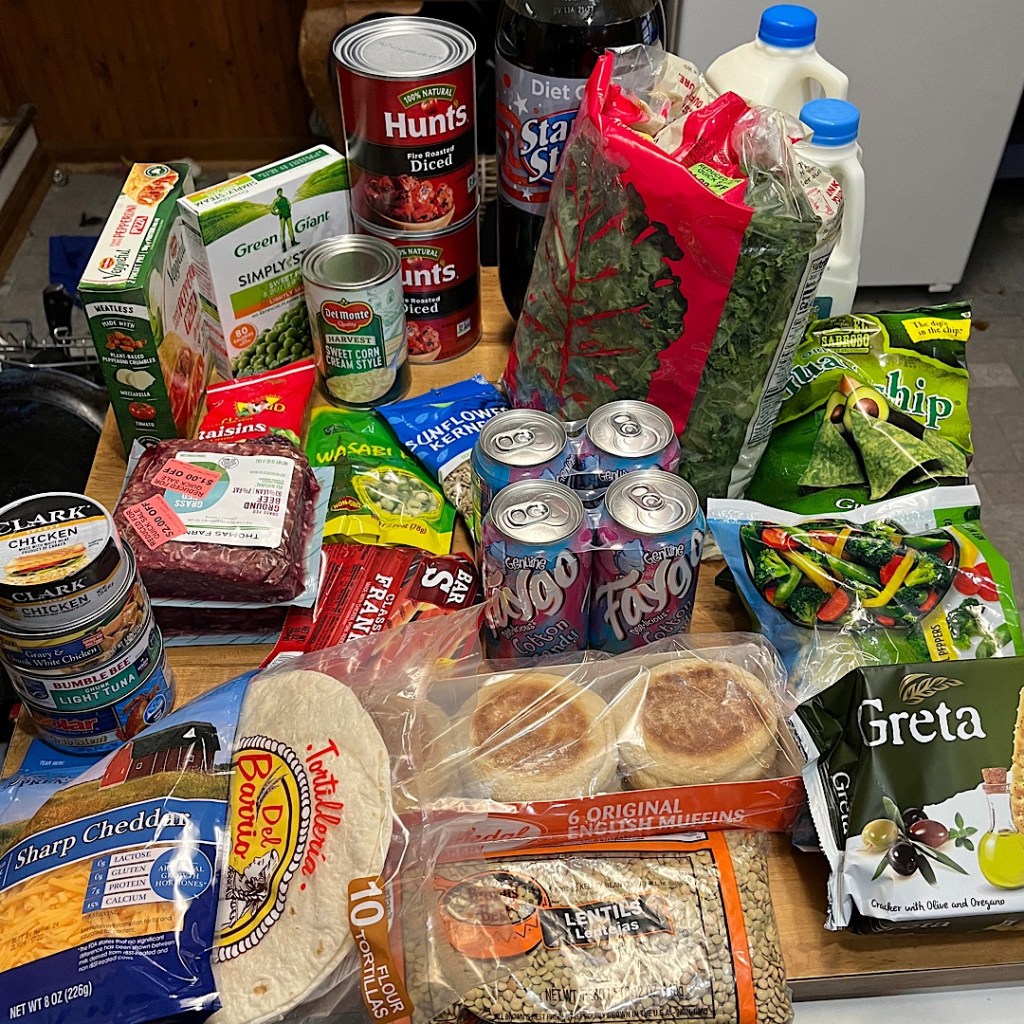

“Prepare a weekly menu” and “put back 10 percent of the things in your [grocery] basket.” Oh, Mr. Dahlstrom. I spend $250 on groceries for myself each month, that does not include the Teenager as she buys her own groceries. And I do get coffee or a donut out, which adds up to about $25 a month, which I consider reasonable as, as you mention, I search for discounts.

Other advice includes: “collect old debts,” “turn unwanted things into cash,” “change your lifestyle,” and “bring in the paying customers” using a talent or skill. Because my half-a-double home that I pay about $900/month for is full of useful items? I haven’t even had a vacation in about five years. And my talent? It brings in about $150/month on a good month.

“Unload the family jewels.” Mr. Dahlstrom, I’m so frugal I wouldn’t even let my husband buy me a diamond for my engagement ring. When we got married, we used Irish claddaghs so all I had to do was switch it to the other hand. I don’t own a single piece of jewelry or any item worth anything. My car is a 2015, my computer is a mid-range model, even my Brooks Brothers suit is 15 years old at this point.

But this is what’s wrong with our country. As a society, we assume everyone “poor” or experiencing financial trouble or unemployment is in that situation because they are irresponsible, stupid or did something wrong. And sometimes that poverty or situational bad luck is due to society’s expectations.

For example, starting with my generation (the GenXers) we insisted that our kids go to college and saddled them with loans to do it. Then, we flooded the market with bachelor’s degrees, which rendered them meaningless, and started pumping up the value of master’s degrees. For those of us associated with the arts or wishing to pursue an academic trajectory, a Ph.D. is now required and some perfectly talented individuals with MFAs are now trapped in a life of eternal adjunct status.

And the poor Millennials also fell victim to this higher education fiasco except the cost has skyrocketed and these poor kids are starting their lives with student loan payments that rival my mortgage and they can’t land a job with a living wage so they work in warehouses with the same people who skipped the education in the first place.

Now, add to that the way the medical system works. In my opinion, and this is just my opinion, more people than ever need some sort of medical support in their life. Whether it be disability, illness, mental health struggles or maintenance medication, it seems like more people than ever spend a ridiculous amount of their income on healthcare.

I have been extremely fortunate that my mathematical brain allowed me to calculate costs and I determined that the free to me high deductible health plan, when you included the employer contribution to my health savings account and a $50 contribution from me to that same HSA each paycheck, paid for most of my medical costs this year (except for my mental health therapist, who for some reason, the medical insurance company likes to pretend doesn’t exist. They just won’t communicate with him or pay him).

Now, before I continue on this rant, I don’t understand why healthcare in this country is primarily connected to employers and employment. Why is it an employer’s responsibility to provide access to healthcare? Eliminating this ridiculous practice might be a good first step to getting healthcare under control. If you meet certain criteria, you can qualify for government-sponsored insurance, which also dictates the level of care you receive, and the open marketplace for healthcare is expensive.

I just don’t understand why everyone isn’t pushed to the open marketplace OR why everyone can’t qualify for government insurance. If everyone went to the open marketplace and insurance companies had to compete for individuals instead of corporations perhaps the access to care would change. In other words– even a company like Stitch Fix– has thousands of employees. If insurance company had to court those individuals and families, they would have to work a lot harder to court them versus convincing one corporation to allow them to insure a large group of individuals.

I missed a month of wages after my hospitalization, which due to the one week waiting period, even with my employer-sponsored short term disability insurance, only provided three weeks of wages at less than 67% of my normal wage, and on top of that the company administering those payments misplaced my paperwork which meant I had to repeating submit paperwork and did not get the last week of those wages until one full month after I returned to work. And my doctor had to submit three sets of paperwork. Which, technically, costs $25 a form for the doctor to submit.

And because I have a congenital and permanent mobility disability, I always need physical therapy. But physical therapy sessions cost hundreds of dollars and insurance companies limit access to them. So I hired a personal trainer and pay him $25 a session (which bless him, he has now reduced his rate to contribute toward my fund to pay for my service dog which is another $5,000) and I bet Mr. Dahlstrom would say I should eliminate that from my budget as an extraneous expense.

But Mr. Dahlstrom, I imagine, does not live with a disability and has probably never experience what it’s like to have a leg that just suddenly stops working or a hip that feels like it’s waving to people from my butt. And since my muscles and my brain literally cannot communicate, I have to physically show them what to do so that movement is reduced to muscle memory and does not have to include the brain.

In closing, I’m going to end this long and winding blog post with a celebration that also highlights everything wrong with America. My friend Southern Candy from Stitch Fix turned 65 yesterday and she asked to go to Shady Maple Smorgasbord. That place was SO BIG, I think my whole d*mn town could have dined together. They had so much food and so many cooking stations I think we could have fed a village from a developing nation for a week.

The staff was amazing. The food was quite good. The gift shop was enormous. And in general, it looked like people were only taking what they could eat. But we all ate too much. I had three dinners and two desserts and spend several hours thinking I might vomit. The cajun catfish and the carrot souffle were my favorite. And I really wanted to punch an old man in the face because as I was reaching for the last piece of coconut custard pie, he snatched it away from me.

And the reality of how much food, how many steaks, how many excess calories we were all consuming filled me with such guilt and shame. Our culture, and you can disagree with me, is so centered on gluttony and selfishness. So while I was happy to spend time with my friend, and take a road trip with her, and laugh with her– I have to ask: how can such a place exist? I’m sure the intent, because Shady Maple started decades ago, was to provide a place where people could dine and have a wide variety of choice and not have to chose, or for families to dine together while pleasing difficult eaters. But this was insane.