I’ll be posting videos about my shopping if that is more your jam (food pun intended) so once I get this typed, I’ll start working on editing that footage.

For those of you who don’t normally read these posts or are new here: I’m a former journalist and the founder of Parisian Phoenix Publishing. I lost my full-time job in September, when Stitch Fix closed their Bethlehem (Pa.) warehouse. I’m hoping this might give me the chance to transition into at least part-time focus on my publishing company and its editorial services.

If you ever wanted to work with me, now is the time to pitch your project ideas. I’ve gone on a lot of interviews, and I high percentage of those led to second interviews. But none have led to a job. And I’m wondering if maybe it’s because I’m not looking for jobs in the word-related fields. I’ve been on social media marketing job interviews and business-related job interviews but none that speak directly to my deepest talents.

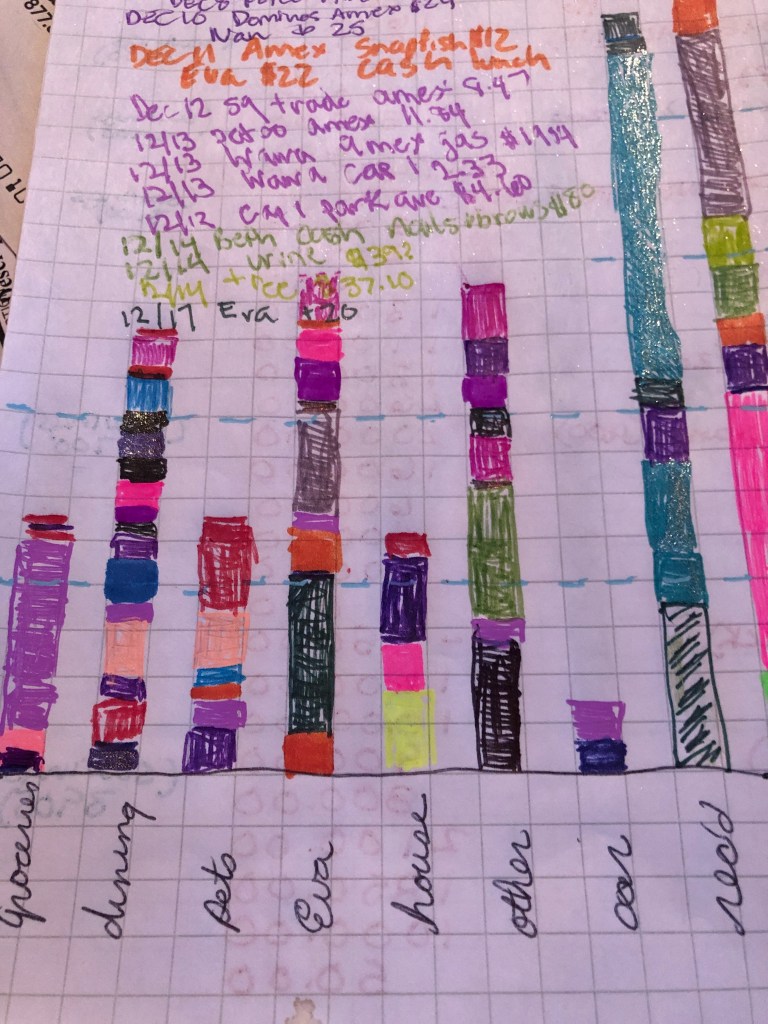

So, the publishing company is keeping me afloat– because unemployment compensation payments literally pay for the mortgage and the car insurance for the teen and I. My thermostat is set on 60. And we’re delaying a lot of things. But thanks to places like the Grocery Outlet and Dollar Tree we still have access to food.

I write these posts in part because I used to have a food blog where I chronicled cooking and shopping on a budget. (angelfoodcooking.blogspot.com) But I have had people tell me that I need to share some of these “tricks” because not everyone knows how to grocery shop on a budget. My daughter literally hands me her debit card and a list.

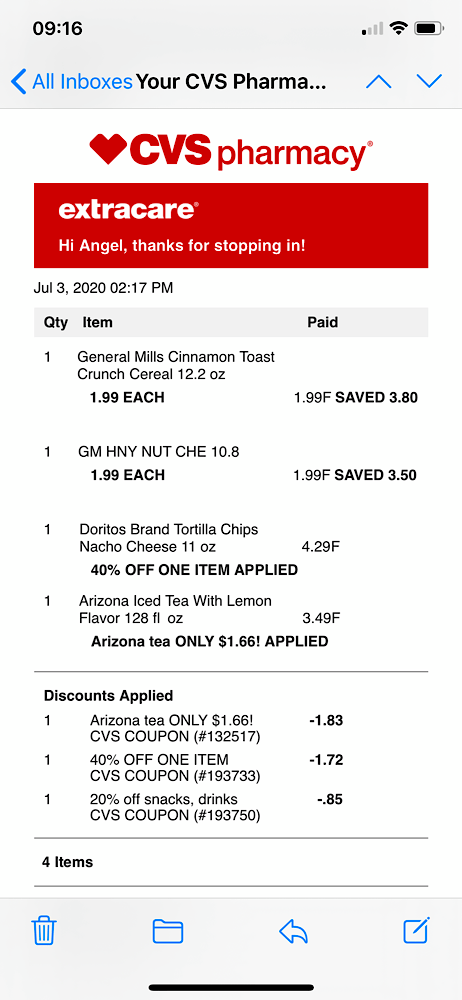

But if I had to tell you my #1 trick for saving money on food and household goods, it would be to know what you pay for things. It sounds lame, but the reality is if you don’t pay attention to what things “normally” cost you, you won’t know if something is a good deal. #2 would be to know the sale cycles. Target, CVS, and the major grocery stores all have sale cycles. Don’t feel pressured to buy something now because it’s “on sale.” That sale will be back, sometimes in as little as a month. Retailers want you to see the sale price and have an impulsive reaction to buy that product because it’s “such a good deal.” But the deal will return, just be patient and keep your eyes open.

#3. This is the one I used today. I set my expectations and my budget before I set foot in the store. I counted my money. I decided I had $20 for each store. In Grocery Outlet, I only considered items around $2.50 (or less). I really wanted the $8 gigantic bag of shredded cheese that would last a month, but that’s almost 1/3 of my budget. So I got the $2 8-ounce bag of shredded cheddar instead. The Teenager wanted chicken, but that also would have been about $8 and more chicken than I really need to survive. And right now we’re in survival mode.

Now, onto the purchases:

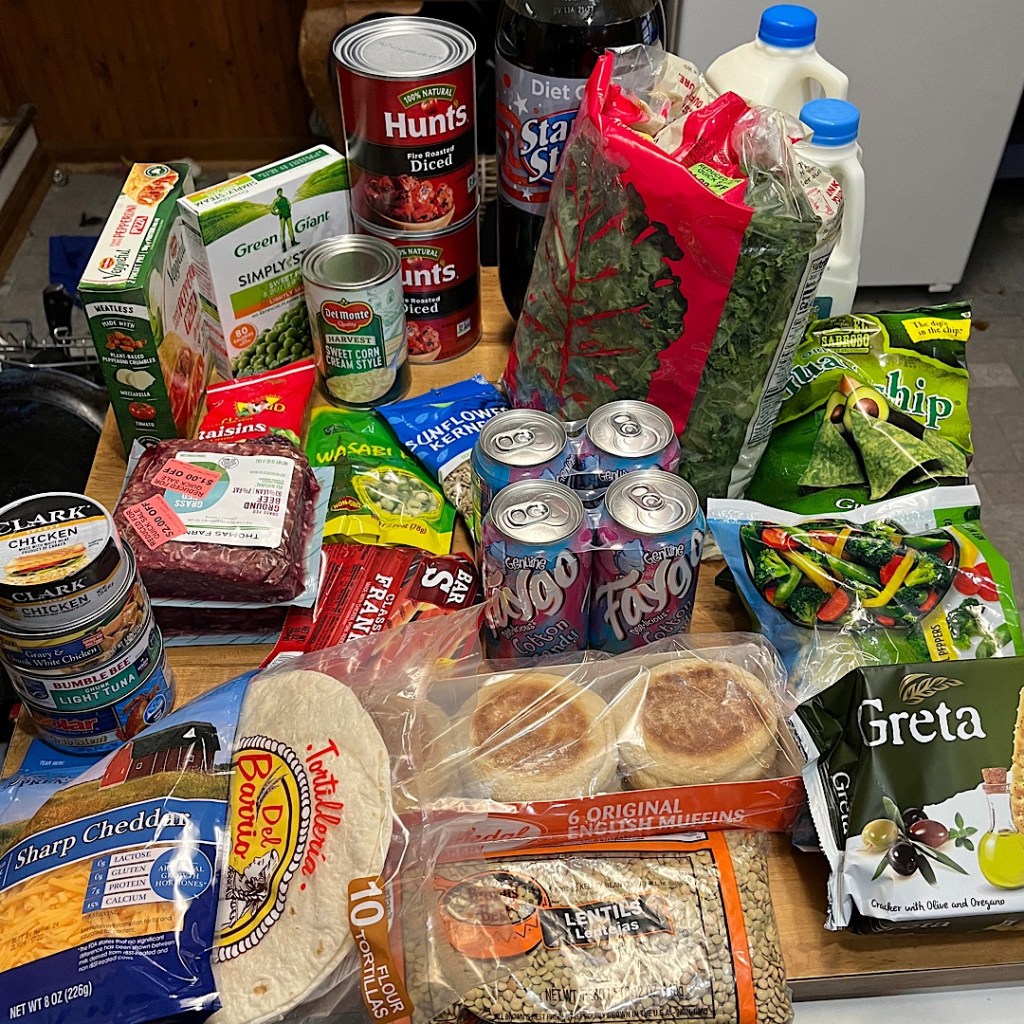

First, Grocery Outlet. I checked the app for any coupons. None available. I read the daily email sent out from them every day, because I’m a junkie. We’re going to build our meals based on what I find, and fill out gaps from products at the Dollar Tree in the same plaza.

- Hunts Fire Roasted Diced Tomatoes, big can. So big I may have to open it, use it, and freeze what’s left. Two cans at 2/$1.00.

- Polar canned crab meat. It was between this and a jar of asparagus. I have some egg roll wrappers in the freezer. OR I have rice noodles in the pantry. $2.99.

- Kale, fresh, big bag, organic. $1.99

- Veggieful plant-based frozen pepperoni pizza pockets, two servings, $1.49

- Green Giant frozen sweet peas in light butter sauce. I suspect I may use this as a sauce for a pasta or rice dish. $0.99

- Half & half, quart, $2.49

- 2% milk, half gallon, $2.12

- 8 ounces shredded sharp cheddar, $1.99

- 2 packs of 93% lean grass-fed, organic ground beef, $2.99 each

Now, over to the Dollar Tree:

- 2.75 liters of generic diet cola (which even though this soda is on the shelf and not cold it rang up as taxable vs. non-taxable. In Pennsylvania, food is technically NOT taxable unless it is considered take-out, so cold, cooler beverages are usually taxed.)

- 4 pack of cans of generic cotton candy soda for the teen (again, rang up as taxable, sigh). I wanted to get sparkling water but I can’t buy all the beverages for only me.

- Almost 15 ounce can of Del Monte creamed corn. Every time we want to make corn bake, we never have creamed corn so I try to keep it in the pantry. It’s also a great way to thicken or even extend soups.

- About 4 ounces canned chicken

- About 5 ounces canned chicken and gravy

- Tuna in water

- English muffins

- 10 flour tortillas

- Olive oil and oregano crackers

- 5 ounces of guacamole flavored tortilla chips

- 12 ounces dry lentils

- 5 ounces sunflower kernels

- almost 3 ounces wasabi peas

- 3 ounces Sunmaid raisins

- 12 ounces frozen stir fry vegetables (peppers, snow peas and broccoli)

- hot dogs

I forgot my darn gnocchi from Dollar Tree. Those are so good.